|

Mining

News

Commodities,

Resources, Elements

News

Mining

Cafe News

Mining

Industry News

Blogs

Media

Man Business Blog

Media

Man News Blog

Factored

Websites

The

Australian Financial Review: Mining

Mining

(Wikipedia)

FX

Pro

NASDAQ

Mining.com.au

The

Australian Mining Review

FOX

Business FOX

News - US Economy

Daily

Updates via Media

Man Int X

Mining/Energy/Resources/Culture:

Australia and World

2025

News

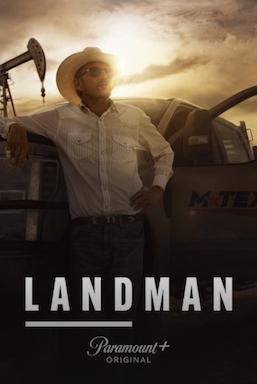

Landman

Oil

and Gas Industry: A landman is a professional who

negotiates and manages land and mineral rights for

oil, gas, or energy companies. They research property

titles, negotiate leases with landowners, ensure compliance

with regulations, and handle contracts. Landmen can

be in-house (working directly for a company) or independent

field landmen (contractors who research records and

negotiate on behalf of companies).

Certifications

like Registered Landman (RL) or Certified Professional

Landman (CPL) are offered by the American Association

of Professional Landmen (AAPL). Their role is critical

in securing rights for exploration and production,

often requiring legal knowledge, negotiation skills,

and courthouse research.

Cultural

References: "Landman" is also the title

of a Paramount+ TV series (premiering 2024, with Season

2 set for November 16, 2025), starring Billy Bob Thornton

as a West Texas oil worker. The show, created by Taylor

Sheridan, portrays the oil industry and has gained

attention for its authenticity and strong performances.

Mining/Energy/Rare

Earths/Biz/Culture/Politics: Australia, U.S and World

Mad

Monday Edition

News

November

2025

Markets

Nov

17

Australian

Dollar: $0.6529 USD (up 0.0001 USD)

Iron Ore: $102.50 USD (down 0.35 USD)

Oil: $60.09 USD (up $1.34 USD)

Gold: $4,080.78 USD (down $82.66 USD)

Copper: $5.0500 USD (up $0.0015 USD)

Bitcoin: $94,324.41USD (down 1.62%)

Dow: 47,147.48 (down 309.74 points)

Bitcoin:

(Near Live) $95,096.48 -0.79%

News

Heavy

Industry Awards

Mack

Trucks wins Media Man 'Truck Manufacturer Of The Month'

award

Caterpillar

wins Media Man 'Heavy Equipment Manufacturer Of The

Month' award

Bingo

Industries wins Media Man 'Construction Brand Of The

Month' award

Elders

wins Media Man 'Agribusiness Of The Month' award

Landman

wins Media Man 'Streaming Series Of The Month' award

(Oil/mining industry based story via Paramount Plus)

News

Wyloo

bets on nickel future as part of critical minerals

boom

Wyloo's

financial accounts show that it booked a $377.6m profit

in 2024-25, after a massive impairment charge on its

nickel assets resulted in a $352.8m loss for the previous

financial year. The private company of Andrew and

Nicola Forrest is continuing to explore for nickel

near its mothballed mines in Western Australia, while

it is also considering the construction of a nickel

concentrator near Kambalda. Wyloo's CEO Luca Giacovazzi

stated in its latest annual report that its future

growth is likely to be on mining and selling nickel,

while this focus is expected to be expanded to include

rare earths. (RMS)

Nov

15

Make

coal great again or China gets your data: Hanson

One

Nation leader Pauline Hanson will release details

of the party's energy policy during the last parliamentary

sitting week for 2025. However, Hanson contends that

amongst other things Australia must withdraw from

the Paris climate agreement and extend the operating

lives of the nation's existing fleet of coal-fired

power stations. Hansen has emphasised the importance

of coal-fired power generation to data centres in

Australia, warning that they will not be able to compete

with China. Hanson adds that it "frightens the

hell out of me" that China will dominate global

data storage due to its lower electricity prices,

which will be at least partly due to coal imported

from Australia. (RMS)

News

Former

Rio boss called to Mongolian probe

A

Mongolian parliamentary inquiry into cost blowouts

at the Oyu Tolgoi copper mine was announced in September,

with public hearings due to be held between December

8 and 12. Slated to be one of the world's top-five

producers of copper by the end of the decade, the

Oyu Tolgoi mine cost almost $US1.7 billion more than

planned and took almost two years longer than expected

to build. Former Rio Tinto CEO Jean-Sebastien Jacques

is one of close to 300 witnesses called to appear

before the inquiry, with Jacques having been CEO of

Rio from 2016 to 2020. (Roy Morgan Summary)

Nov

14

BHP

to learn class action fate for $72b Brazil dam disaster

The

UK's High Court will shortly issue a ruling on whether

BHP is legally for an iron ore tailings dam disaster

in Brazil which killed 19 people and caused massive

environmental damage in November 2015. The tailing

dam was owned by the Samarco joint venture between

BHP and iron ore rival Vale. Should BHP be found to

be legally liable, individual claimants' eligibility

for compensation and the size of any payouts will

be determined in the next stage of the long-running

case. BHP and Vale have already paid billions in compensation

to people who were affected by the disaster. (RMS)

News

Fresh

probe launched into MinRes, Ellison

It

has been revealed that the Australian Taxation Office

has launched a new investigation into Mineral Resources

and its billionaire founder Chris Ellison. News of

the investigation was revealed in a request sent by

the ATO to the Federal Court in October for access

to previously sealed documents that had been filed

in the unfair dismissal case brought by MinRes' former

procurement manager Steve Pigozzo in 2022. The new

investigation will focus on how MinRes and Ellison

calculated income and fringe benefit taxes, with the

revelation regarding the new probe coming as MinRes

prepares to hold its AGM next week, at which shareholders

will be asked to approve a lucrative share options

package for new chairman Malcolm Bundey. (Roy Morgan

Summary)

News

Rio

ends two-decade Serbia lithium mining dream as cost

cuts bite

Rio

Tinto has advised that its Jadar lithium project in

Serbia has put in 'care and maintenance' mode. The

company will cease undertaking environmental, heritage

and geological surveys at the site in the Jadar Valley,

four years after revealing plans to invest $US2.4bn

($3.7bn) on developing what it claimed would be the

biggest lithium mine in Europe. There is growing competition

for capital within Rio Tinto's lithium division, and

its $10bn deal to acquire Arcadium Lithium earlier

in 2025 added several mines that are already in production

to its lithium portfolio. (RMS)

News

American

activist claims IperionX more dud than minerals gem

Trading

in the shares of Australian-listed IperionX were halted

on Thursday, following the release of a report into

the company by New York hedge fund Spruce Point Capital

Management, which specialises in short-selling. With

the US-based IperionX seeking to develop titanium

extraction technology and having been backed by the

Trump administration as part of its bid to secure

domestic production of critical minerals, Spruce Point's

report sought to raise doubt about IperionX's prospects.

(RMS)

News

Biotech

gets $20m in critical minerals push

US-based

biotechnology firm Endolith has raised $US13.5m ($20.6m)

via its initial round of venture funding, while it

aims to raise an additional $3m in a second tranche.

The start-up is developing technology that can be

used to extract critical minerals such as copper from

low-grade ore and waste rock that would be unprofitable

to process using traditional methods. Endolith's technology

uses microbes and artifical intelligence, and the

company aims to commence real-world trials at a mine

site within 6-12 months. (RMS)

News

Oversupply

of oil could create glut of 4m barrels a day, says

energy watchdog

The

International Energy Agency has stated in its latest

monthly report that the world is producing more oil

than it needs, and that there could be a glut of 4m

excess barrels a day entering the market by 2026.

The IEA's warning has come in the same week that it

issued its latest energy outlook report, which included

a controversial scenario in which global oil demand

would continue to grow until 2050. It had dropped

the scenario in 2020 after it was accused of repeatedly

criticised for underestimating the growth of renewable

energy in its annual report, but returned the scenario

to its outlook this year after calls from the White

House to present a more optimistic view for the future

of oil. (RMS)

News

Markets

Australian

Dollar: $0.6528 USD (down $0.0012 USD) Iron Ore: $102.85

USD (up $0.20 USD) Oil: $58.75 USD (up $0.33 USD)

Gold: $4,163.44 USD (down $33.38 USD) Copper: $5.0485

USD (down $0.0345 USD) Bitcoin: $98,332.56 USD (down

3.01%) Dow Jones: 47,460.49m (down 794.33 points)

Bitcoin:

(Near Live) $97,618.71 =5.38%

News

The

cryptocurrency market is stagnating, lagging its competitors

Market

Overview

The cryptocurrency market capitalisation has changed

little over the past day, fluctuating around $3.5

trillion. The cryptocurrency fear index has fallen

to 15, its lowest level since 4 March. Notably, the

cryptocurrency market has been left out of the recent

rally in precious metals and stock indices. If this

is not an attempt by whales to lock in profits from

the rally since April or even from the growth of the

last two years, then it is an alarming signal of deep-seated

risk aversion that is about to manifest itself in

larger markets.

Bitcoin

continues to struggle to remain within the bull market

on weekly timeframes, trying to stay above the 50-week

moving average. Last week's close was on the edge

and attempts to develop an offensive this week are

running into sell-offs, despite the favourable external

backdrop. The previous such transition occurred at

the end of 2021, and so far, everything aligns with

the 4-year halving cycles that many were quick to

dismiss.

News

Background

Over

the past three months, a clear break has occurred

in the correlation between Bitcoin and the stock market.

The S&P 500 stock index has risen 7% during this

time, while BTC has lost 15%. Judging by four years

of close correlation, it can be argued that Bitcoin

is currently undervalued, according to Santiment.

Jan3

founder Samson Mow attributes Bitcoin's decline to

a massive sell-off by investors who bought it over

the past 12 to 18 months. They are rushing to lock

in profits amid rumours of an imminent bearish trend

in the crypto market.

The

crypto market's growth phase is nearing its end, so

it is time for investors to consider locking in profits

and reducing the share of crypto assets in their portfolios,

according to Morgan Stanley, which cites a four-year

cycle that the cryptocurrency market has consistently

followed since 2009.

The

bitcoin mining industry is facing a difficult period

due to growing competition and declining profitability,

said MARA CEO Fred Thiel. According to him, only those

miners who have access to cheap energy or new business

models will survive.

According

to SoSoValue, spot Solana ETFs in the US have attracted

more than $350 million in 11 trading sessions. The

steady inflow of funds into new SOL ETFs came as a

surprise to the market. The results significantly

exceeded initial conservative forecasts, according

to LVRG Research.

Visa

has unveiled a pilot project called Visa Direct, which

allows US customers to make direct cross-border payments

in USDC stablecoin to recipients' wallets. The initiative

is aimed at content creators and freelancers.

The

crypto industry is entering a new phase of capital

raising. The launch of Coinbase's ICO platform is

expected to be a key event in this trend, according

to Bitwise. The exchange will select and launch one

verified project per month. (FxPro)

News

The

dollar emerging from the data fog

•

The US government shutdown is over. • Central

bank policy convergence helps EURUSD. • Political

scandal causes the pound to fall. • Japan's currency

interventions are ineffective The House of Representatives

voted 222 to 209 to resume government operations.

The president immediately signed the document. The

record-long shutdown is over. This fact promises that

the Fed and investors will soon begin to exit their

positions. The president immediately signed the document.

The record-breaking shutdown is over. This fact suggests

that the Fed and investors will quickly start to emerge

from the fog once statistics are published again,

allowing them to make data-driven decisions. But will

they like what they see when the picture becomes clearer?

Alternative sources show a slowdown in the US GDP.

The IMF forecasts a decline in its growth rate from

2.8% to 2% in 2025. The eurozone, on the other hand,

is expected to accelerate from 0.9% to 1.2%. At the

same time, the Bank of France plans to raise its estimates

for the country, despite the ongoing political turmoil.

The narrowing divergence in economic growth argues

in favour of maintaining the upward trend for EURUSD.

The same can be said about monetary policy. The ECB

has most likely ended its easing cycle, barring any

major shocks. The federal funds rate is likely to

continue falling amid a cooling US labour market and

economy. The euro has advantages over the dollar.

However, in the short term, mixed data could lead

to mixed movements in EURUSD.

The conflict on Downing Street has allowed GBPUSD

bears to launch a new attack. When Labour came to

power in Britain in 2024, the pound gained preference

thanks to hopes for political stability after constant

ministerial changes under the Conservatives. However,

since then, Prime Minister Keir Starmer's ratings

have been falling. Rumours of a plot to replace the

leader have made investors nervous and prompted them

to sell sterling. Doubts about the effectiveness of

potential currency interventions continue to push

the USDJPY pair higher. The current conditions differ

from those of last year. Back then, Tokyo intervened

in the FOREX market before raising the overnight rate.

Now, Sanae Takaichi is sticking to a policy of fiscal

and monetary stimulus. Any purchase of the yen will

only have short-term success. In addition, it will

require the expenditure of foreign exchange reserves.

These are needed to make the investments in the US

economy promised to Donald Trump. (FxPro)

News

Heavy

Industry Awards

Mack

Trucks wins Media Man 'Truck Manufacturer Of The Month'

award

Caterpillar

wins Media Man 'Heavy Equipment Manufacturer Of The

Month' award

Bingo

Industries wins Media Man 'Construction Brand Of The

Month' award

Elders

wins Media Man 'Agribusiness Of The Month' award

Landman

wins Media Man 'Streaming Series Of The Month' award

(Oil/mining industry based story via Paramount Plus)

News

Media

Google

Finance wins Media Man 'Business News Website Of The

Month' award; Runner-up: Yahoo! Finance

Netflix

wins Media Man 'Streaming Service Of The Month' award;

YouTube and Paramount Plus are runner-ups! Strong

mention: Tubi

News

News

Pop

Culture News

Landman

(Paramount Plus)

Plot

Set

against the backdrop of the booming West Texas oilfields,

Landman follows Tommy Norris (Billy Bob Thornton),

a crisis manager and landman for an independent oil

company. Tommy navigates cutthroat deals, family tensions,

and moral dilemmas while trying to keep his business

afloat. The story kicks off with an investigation

into a fatal accident involving an out-of-town lawyer,

weaving in elements of drug cartels.

Landman

is an American drama television series created by

Taylor Sheridan and Christian Wallace, inspired by

Wallace's podcast Boomtown. It explores the high-stakes

world of the oil industry in West Texas, blending

themes of fortune-seeking, corporate intrigue, and

personal drama amid roughnecks, billionaires, and

geopolitical shifts.

The

series premiered on Paramount+ on November 17, 2024,

and has been renewed for a second season.

Landman:

Season 2. Trailer (Paramount Plus)

https://youtube.com/watch?v=mhzQawESdqg

"You

think you understand how this business works, but

you don't." Things are heating up in the final

Landman trailer. Season 2 premieres November 16, 2025,

only on Paramount+.

"Death

and a Sunset"

November 16, 2025

"Sins

of the Father"

November 23, 2025

"Almost

a Home"

November 30, 2025

"Dancing

Rainbows"

December 7, 2025

"The

Pirate Dinner"

December 14, 2025

"Dark

Night of the Soul"

December 21, 2025

"Forever

Is an Instant"

December 28, 2025

"Handsome

Touched Me"

January 4, 2026

"Plans,

Tears and Sirens"

January 11, 2026

"Tragedy

and Flies"

January 18, 2026

News

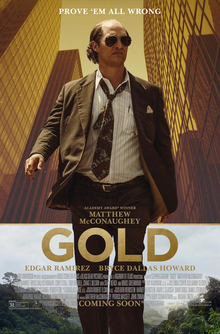

Gold

Movie

Gold

is a 2016 American epic crime drama film directed

by Stephen Gaghan and written by Patrick Massett and

John Zinman. The film stars Matthew McConaughey, Édgar

Ramírez, Bryce Dallas Howard, Corey Stoll,

Toby Kebbell, Craig T. Nelson, Stacy Keach and Bruce

Greenwood. The film is loosely based on the true story

of the 1997 Bre-X mining scandal, when a massive gold

deposit was supposedly discovered in the jungles of

Indonesia; however, for legal reasons and to enhance

the appeal of the film, character names and story

details were changed.

Trailer

Gold

(YouTube Movies and TV)

https://youtube.com/watch?v=yc0S96OZhi0

Gold

is the epic tale of one man's pursuit of the American

dream, to discover gold. Starring Oscar® winner

Matthew McConaughey (Interstellar, Dallas Buyers Club,

The Wolf Of Wall Street) as Kenny Wells, a modern

day prospector desperate for a lucky break, he teams

up with a similarly eager geologist and sets off on

an amazing journey to find gold in the uncharted jungle

of Indonesia. Getting the gold was hard, but keeping

it would be even harder, sparking an adventure through

the most powerful boardrooms of Wall Street. The film

is inspired by a true story.

News

Best

Quotes

The

best and biggest gold mine is in between your ears."

"You

are a gold mine of potential power. You have to dig

to find it and make it real."

"Your

mind is like a gold mine, if you dig deep you will

find something golden."

"Don't

die without mining the gold in your mind."

"We're

like goldfields. Until we dig deep to find what's

inside us, our true potentials may be hidden forever."

"If

you want to find gold, you've got to love the process

of digging."

"Even

if you're sitting on a gold mine, you still have to

dig."

"Develop

men the same way gold is mined"

"Don't

go into the mine looking for dirt; instead, go in

looking for the gold."

"A

prospector's job is to remove dirt as quickly as possible"

"A

prospector who analyses every speck of dirt won't

find much gold"

"The

world is sitting on a gold mine but knows it not."

"Make new friends, but keep the old; Those are

silver, these are gold."

"All

that is gold does not glitter."

"Gold

is forever. It is beautiful, useful, and never wears

out"

"Gold

is the money of kings"

"Mining

is the art of exploiting mineral deposits at a profit.

An unprofitable mine is fit only for the sepulcher

of a dead mule."

"Anyone

can find the dirt in someone. Be the one that finds

the gold."

"True

gold fears no fire."

"The

desire of gold is not for gold. It is for the means

of freedom and benefit."

"Make

new friends, but keep the old; Those are silver, these

are gold."

"When

taken for granted, gold in one's hand is sometimes

considered like cheap copper – so are people."

Media

Man

Roy

Morgan wins Media Man 'News Services Provider Of The

Month' award; Runner-ups: X, Google News, Yahoo! Finance

Mining/Energy/Resources/Markets/Politics/Culture:

Australia, US and World

October

2025

Thirsty

Thursday Media Watercooler: All That Glitters? Drill,

Baby Drill!

Search For Industry Culture and Beyond The Harsh Earth

Surface; Wealth Found In Dirty Jobs

Oct

30

Pop

Culture News

Plot

Set

against the backdrop of the booming West Texas oilfields,

Landman follows Tommy Norris (Billy Bob Thornton),

a crisis manager and landman for an independent oil

company. Tommy navigates cutthroat deals, family tensions,

and moral dilemmas while trying to keep his business

afloat. The story kicks off with an investigation

into a fatal accident involving an out-of-town lawyer,

weaving in elements of drug cartels.

Landman

is an American drama television series created by

Taylor Sheridan and Christian Wallace, inspired by

Wallace's podcast Boomtown. It explores the high-stakes

world of the oil industry in West Texas, blending

themes of fortune-seeking, corporate intrigue, and

personal drama amid roughnecks, billionaires, and

geopolitical shifts.

The

series premiered on Paramount+ on November 17, 2024,

and has been renewed for a second season.

Landman:

Season 2. Trailer (Paramount Plus)

https://youtube.com/watch?v=mhzQawESdqg

"You

think you understand how this business works, but

you don't." Things are heating up in the final

Landman trailer. Season 2 premieres November 16, 2025,

only on Paramount+.

"Death

and a Sunset"

November 16, 2025

"Sins

of the Father"

November 23, 2025

"Almost

a Home"

November 30, 2025

"Dancing

Rainbows"

December 7, 2025

"The

Pirate Dinner"

December 14, 2025

"Dark

Night of the Soul"

December 21, 2025

"Forever

Is an Instant"

December 28, 2025

"Handsome

Touched Me"

January 4, 2026

"Plans,

Tears and Sirens"

January 11, 2026

"Tragedy

and Flies"

January 18, 2026

News

Gold

Movie

Gold

is a 2016 American epic crime drama film directed

by Stephen Gaghan and written by Patrick Massett and

John Zinman. The film stars Matthew McConaughey, Édgar

Ramírez, Bryce Dallas Howard, Corey Stoll,

Toby Kebbell, Craig T. Nelson, Stacy Keach and Bruce

Greenwood. The film is loosely based on the true story

of the 1997 Bre-X mining scandal, when a massive gold

deposit was supposedly discovered in the jungles of

Indonesia; however, for legal reasons and to enhance

the appeal of the film, character names and story

details were changed.

Trailer

Gold

(YouTube Movies and TV)

https://youtube.com/watch?v=yc0S96OZhi0

Gold

is the epic tale of one man's pursuit of the American

dream, to discover gold. Starring Oscar® winner

Matthew McConaughey (Interstellar, Dallas Buyers Club,

The Wolf Of Wall Street) as Kenny Wells, a modern

day prospector desperate for a lucky break, he teams

up with a similarly eager geologist and sets off on

an amazing journey to find gold in the uncharted jungle

of Indonesia. Getting the gold was hard, but keeping

it would be even harder, sparking an adventure through

the most powerful boardrooms of Wall Street. The film

is inspired by a true story.

News

Oct

30

Markets

Australian

Dollar: $0.6570 USD (down $0.0010 USD)

Iron Ore: $107.75 USD (up $1.35 USD)

Oil: $60.40 USD (up $0.48 USD)

Gold: $3,933.57 USD (down $20.40 USD)

Copper: $5.2030 USD (up $0.0320 USD)

Bitcoin: $111,274.01 USD (down 1.22%)

Dow: 47,632.00 (down 74.37 points)

News

Fading

Roy Hill seeks new riches

Iron

ore miner Roy Hill has posted a net profit of $1.8bn

for 2024-25, compared with $3.2bn in the previous

financial year; it is the Gina Rinehart-backed company's

lowest profit since 2019-20. Roy Hill's iron ore shipments

totalled 61.6 million tonnes in 2024-25, compared

with 64 million tonnes previously. The company's latest

results were marred by factors such as lower iron

ore prices and production disruptions caused by Cyclone

Zelia in early 2025. Roy Hill's flagship mine is estimated

to have a remaining production life of about seven

years, but Rinehart says the new McPhee mine will

extend the operating life of the Roy Hill mine. (RMS)

News

Northern

Minerals faces battle for board

A

spokesman for Northern Minerals says its four directors

take their role of acting in the best interests of

all shareholders very seriously. They add that the

board supports the re-election of executive chairman

Adam Handley at the upcoming AGM in order to maintain

a "stable, united and effective board",

while it opposes the election of non-endorsed nominees

for the same reasons. Chinese businessman Enping Fu

and Sydney-based businesswoman Joanna Yanis are seeking

to be elected to the board of the heavy rare earths

miner; the former narrowly failed to do so in 2024.

The federal government ordered companies with Chinese

links to divest shares in Northern Minerals last year,

due to the strategic importance of its Browns Range

project. (RMS)

News

Trunp's

$121b nuclear deal fresh blow to uranium short-sellers

The

share prices of Australian-listed uranium producers

rallied on Wednesday after the Trump administration

revealed plans to spend US80bn ($121.4bn) on new nuclear

reactors across the US. The deal with Westinghouse

Electric is aimed at ensuring a reliable electricity

supply for the power-hungry data centres that will

drive the artificial intelligence revolution. Westinghouse

is owned by private equity firm Brookfield and uranium

miner Cameco; the latter's shares rose by 23 per cent

in response to the deal. Meanwhile, the proportion

of Australian uranium stocks that are held by short-sellers

has fallen sharply in recent weeks. (RMS)

Oct

29

BHP-backed

firm adds value to US-Australia deal

Innovative

technology that can extract critical minerals from

mining waste is being trialled at Rio Tinto's Kennecott

copper mine in the US. SiTration is seeking to commercialise

its silicon membrane filter, and BHP's ventures arm

participated in its second round of fundraising from

seed investors in 2024. SiTration's co-founder and

CEO Brendan Smith says its filter is being used to

process acid mine drainage at Kennecott to extract

"market-ready" copper. Recent academic research

from the Colorado School of Mines suggested that waste

by-products stored at 54 hard-rock metal mines may

contain at least $US10bn worth of copper and more

than $US1bon of rare earths. SiTration was spun off

by the Massachusetts Institute of Technology in 2020.

(RMS)

News

Gold

below $US4000, 'deeper' losses ahead

The

gold price has fallen 9.1 per cent since reaching

a record high of $US4,381 an ounce last week. Tony

Sycamore from IG Markets says the gold price's fall

below $US4,000/ounce indicates that a deeper pullback

to around the $US3,500 level is likely. Ole Hansen

from Saxo Bank says the price of bullion could take

some time to rebound if there is a deep pullback,

and suggests that any recovery may not occur until

next year. The prospect of a US-China trade deal may

also weigh on the gold price, given that economic

concerns and geopolitical tensions have been a key

driver of demand for the traditional 'safe haven'

asset. (RMS)

News

Rinehart

weathers the storm as Atlas profits plunge from weaker

prices

Hancock

Propecting-owned Atlas Iron has posted a $260m profit

for 2024-25, which is nearly 41 per cent lower than

previously. The result was marred by lower iron ore

prices and the impact of Cyclone Zelia on production

at its Mount Webber, Sanjiv Ridge and Miralga iron

oire mines in the Pilbara; Atlas achieved annual sales

totalled $10m for the financial year. Mining magnate

Gina Rinehart amalgamated Atlas and Roy Hill in mid-2025

to form Hancock Iron Ore. The group's new McPhee iron

ore mine is slated to commence production in the current

financial year. (RMS)

News

Gina

Rinehart backs Arafura's $475m raise in rare earths

stampede

Hancock

Prospecting will increase its stake in Arafura Rare

Earths from 9.4 per cent to 15.7 per cent after agreeing

to buy $125m worth of shares in the rare earths group's

proposed $475m placement. Arafura intends to issue

new shares at $0.28 apiece, which is a 28 per cent

discount to its most recent trading price. The share

placement will provide nearly all of the remaining

capital Arafura needs for its Nolans rare earths project

in the Northern Territory. Arafura aims to make a

final investment decision on Nolans in early 2026.

(RMS)

News

Taxpayer-backed

Liontown burns through cash after $363m raise

Liontown

Resources has advised that it produced 87,172 tonnes

of lithium concentrate in the September quarter, which

is one per cent higher than the previous quarter.

However, sales volumes were 20 per cent lower at 77,474

tonnes and revenue fell 29 per cent to $68m. Meanwhile,

its cost of production was $US715 per tonne, while

it received an average of $US700 per tonne from buyers.

Liontown raised $363m from investors in August, while

it spent $44m during the September quarter. The federal

government's National Reconstruction Fund recently

invested $50m in Liontown. (RMS)

News

Glencore

walks away from taxpayer-funded clean energy pivot

Anglo-Swiss

miner Glencore has advised that it will not proceed

with a proposed renewable energy and battery hub at

its Murrin Murrin nickel mine and refinery in Western

Australia. Glencore had received a $35m grant from

the federal government's Powering the Regions Fund

to help finance the development of an 849-hectare

renewables hub at Murrin Murrin, which currently operates

its own gas-fired power station. A spokesman for Glencore

says it decided to cancel the onsite hybrid renewable

energy project due to a range of macroeconomic and

cost factors. Glencore and the government have agreed

to mutually terminate the grant. (RMS)

News

Markets

Australian

Dollar: $0.6580 USD (up $0.0020 USD) Iron Ore: $106.40

USD (up $0.70 USD) Oil Price: $59.92 USD (down $1.64

USD) Gold: $3,953.97 USD (down $45.33 USD) Copper

(CME): $5.1710 USD (up $0.0125 USD) Bitcoin: $112,972.09

USD (down 1.57%) Dow: 47,706.37 (up 161.78 points)

News

Oct

28

US

expects China to shelve restrictions on rare earths

US

Trade Representative Jamieson Greer says that staving

off China's rare earth restrictions was one of the

major objectives of the talks between the US and China

during the ASEAN summit in Malaysia. A Chinese official

has indicated that the two sides reached a preliminary

consensus on a number of issues, including export

controls on rare earths, shipping levies and fentanyl.

US Treasury Secretary Scott Bessent in turn believes

that China will delay its rare earth restrictions

for 12 months, while it re-examines the policy. (RMS)

News

PM

reassures Beijing over US minerals deal

Prime

Minister Anthony Albanese has met with Chinese Premier

Li Qiang on the sidelines of the ASEAN summit in Kuala

Lumpur. Xi urged Australia to deepen its co-operation

with China amid growing global instability and uncertainty,

while Albanese said he is committed to maintaining

a stable relationship with China. Albanese also contended

that the $13bn critical minerals and rare earths deal

with the US should not affect Australia's bilateral

relationship with China. President Donald Trump is

scheduled to meet with his Chinese counterpart Xi

Jinping at the APEC summit in South Korea on Thursday,

with hopes that they will be able to secure a trade

deal. (RMS)

News

Trump's

critical minerals advisor jets to Perth for talks

with leaders after Albanese's deal

Anita

Logiudice from the Chamber of Minerals & Energy

of Western Australia says the state is "ground

zero" for America's interest in critical minerals.

She notes that WA accounts for half of Australia's

critical minerals reserves, and it is the world's

fourth biggest producer of rare earths. The importance

of WA has been underlined by the Trump administration's

decision to send its deputy assistant secretary for

critical minerals and metals to Perth in the wake

of the landmark critical minerals deal between Australia

and the US. A state government spokesperson says Assistant

Secretary Joshua Kroon will hold talks with mining

industry executives on growing links and investment

in WA's resources sector. (Roy Morgan Summary)

News

Australia's

plan to challenge China's dominance in critical minerals

and rare earths

About

90 per cent of all rare earths are refined in China,

but the nation has a complete monopoly when it comes

to heavy rare earths. Companies or countries that

produce rare earths ship their raw material to China

for processing, giving it almost complete control

over marketing and pricing. The ABC's chief business

correspondent Ian Verrender explains to The Business

host, Kirsten Aiken, that to maintain its monopoly,

China has never been afraid of using its market power.

Verrender says it has alternatively flooded markets

with material to make it uneconomic for others to

establish rival industries, or denied access to refined

product to others as punishment. Such overwhelming

supply domination, and the pricing power that comes

with it, has raised questions over whether governments

should continue to allow market forces to determine

the supply of materials vital for national security

and development in an increasingly divided world.

(Roy Morgan Summary)

News

Bowen

told: electricity bills will jump

The

unredacted version of the incoming government brief

to Climate Change Minister Chris Bowen shows that

his department had warned that there is likely to

be a "further significant increase" in retail

electricity prices during 2025-26. The Department

of Climate Change, Energy, Environment &

Water also advised that emissions reductions will

need to accelerate rapidly for the federal government

to achieve its 2030 climate targets, and that "full

and timely" implementation of Bowen's first-term

reforms will be essential. The brief was prepared

by Bowen's department following the election in May,

but it initially resisted requests to release the

document in full. (RMS)

News

Mining

billionaire's economic warning

Fortescue's

founder and executive chairman Andrew Forrest says

Australia has a "fantastic" future in manufacturing.

Forrest adds that Australia can compete against the

best of the world, but he contends that the nation

must target areas where it is the best rather than

simply trying to prop up "old industries".

He also says Australia must avoid trying to compete

with industrial powerhouses like China and the US

in these industries. Meanwhile, Forrest says governments

are underestimating Australians by propping up struggling

or failing businesses such as the Mount Isa copper

smelter in Queensland and the Port Pirie lead smelter

in South Australia. (RMS)

News

ASX

rises in broad rally; rare earths tumble

The

Australian sharemarket posted a solid gain on Monday,

with the S&P/ASX 200 adding 0.4 per cent to close

at 9,055.6 points. Investor sentiment was boosted

by growing expectations of further monetary policy

easing in the US and hopes that the US and China will

negotiate a trade deal. Life360 was up 4.7 per cent

at $50.14, Woodside Energy rose 1.2 per cent to $24.69

and Qantas ended the session 3.4 per cent higher at

$10.87. However, Arafura Rare Earths fell 9.6 per

cent to $0.37 and Ramelius Resources was down 5.7

per cent at $3.30. (RMS)

News

Commodities

boom boosts ASX profits by $4b

Analysts

are upbeat about the earnings outlook for companies

in the benchmark S&P/ASX 200 Index. The rise in

commodity prices over the last two months have prompted

analysts to forecast earnings growth of 7.1 per cent

for top-200 stocks in 2025-26; this compares with

forecasts of just 3.1 per cent at the end of the August

reporting season. The resources sector is now forecast

to post earnings growth of 11 per cent in the current

financial year, compared with expectations in August

that earnings would fall by one per cent. Analysts

are also upbeat regarding some non-resources stocks,

including the ANZ Bank, CSL and James Hardie Industries.

(RMS)

News

Major

Tomago investor writes off smelter in gloomy update

Norsk

Hydro has written down the value of its 12.4 per cent

stake in the Tomago aluminium smelter in NSW to zero.

The Oslo-based company has progressively written down

its stake over recent years, and it has warned that

the smelter faces an uncertain future when AGL Energy's

electricity supply contract ends in 2028; Norsk Hydro

adds that it has been difficult to find an affordable

renewable supply for Tomago. The smelter's biggest

shareholder, Rio Tinto, has previously indicated that

it will not continue to operate smelters in Australia

beyond 2030 unless they can be converted to use clean

energy. (RMS)

News

Going

where the profit is

For

most of the first 130 years of BHP's existence, the

focus of successive CEOs was increasing and developing

the company's resources base, rather than profits.

With BHP recently celebrating its 140th anniversary,

profits and returns on capital now take precedence.

Likewise, during BHP's first 130 years Australia knew

that its prosperity would depend on exports of agriculture

and mining products, which would in turn require cheap

energy and strong agricultural support. However, the

nation now makes mining and agricultural development

harder, and it has abandoned low-cost energy. Meanwhile,

BHP's South Australian copper project has been pushed

back to the 2030s, and the company will use its iron

ore cash flows to develop copper mines in countries

where returns and energy costs are competitive. (Roy

Morgan Summary)

News

Antimony

miner shoots down US takeover bid

Critical

minerals producer Larvotto Resources has formally

rejected a takeover offer from the United States Antimony

Corporation. Larvotto's directors have concluded that

the $723m all-scrip bid materially undervalues the

company, which is set to resume production at the

mothballed Hillgrove gold and antimony mine in NSW

in 2026; Larvotto bought the mine from administrators

in late 2023. Meanwhile, Northern Minerals has completed

a $60.5m share placement to new investors; its Browns

Range project in Western Australia includes heavy

rare earths such as terbium and dysprosium. (RMS)

News

Long

haul, but it's a win for MinRes

Mineral

Resources has advised that 8.75 million tonnes of

iron ore were transported via its 150km private haulage

road between 1 August and 27 October. This lifted

the Onslow Iron venture's annualised haulage rate

to 35 million tonnes; this in turn triggered a $200m

contingency payment from Morgan Stanley Infrastructure

Partners, which acquired a 49 per cent stake in the

private road in 2024. Mineral Resources' MD Chris

Ellison says that achieving the haul-road's performance

target so early in Onslow Iron's ramp-up phase demonstrates

the quality of the company's people, partners and

infrastructure. The private road has been the subject

of safety concerns amid a number of truck rollovers

and costly resurfacing work. (RMS)

News

Haoma

Mining Shareholder Update

Haoma

Mining NL Announcements

28

October 2025

(Roy

Morgan Summary)

The

2025 Annual General Meeting of Haoma Mining NL will

be held at 9.30am on 26 November at Tonic House, 386

Flinders Lane, Melbourne. A formal Notice of Meeting

will be sent to all shareholders. Meanwhile, the Haoma

Rare Earths Overview has brought together an overview

of the company's Pilbara assets and their geological

status; test-work undertaken over several years on

those assets by BHP, Anglo America, SQM and Haoma;

and their potential for Heavy Rare Earths as well

as gold. Haoma's shareholder update also includes

progress on Bamboo Creek Test-work from July to October

2025, including physical gold recovered from recent

Elazac Process test-work conducted in Haoma's Bamboo

Creek Laboratory. Haoma's Board in turn resolved on

22 October to allocate performance rights to a number

of employees, consultants and contractors who are

associated with Haoma. (RMS)

News

$US50m

deal for development of Ravensthorpe gold project

Medallion

Metals has advised that it has secured a deal for

Trafigura to arrange and provide a $US50m ($77m) senior

secured prepayment facility. Medallion says the debt

financing facility will underpin the funding required

for the development of its Ravensthorpe Gold Project

in Western Australia, as well as the processing operations

at the Forrestania nickel assets that it has agreed

to buy from IGO. The deal with Trafigura also includes

an offtake agreement for gold dore, copper and precious

metal concentrate. (RMS)

News

Best

Quotes

The

best and biggest gold mine is in between your ears."

"You

are a gold mine of potential power. You have to dig

to find it and make it real."

"Your

mind is like a gold mine, if you dig deep you will

find something golden."

"Don't

die without mining the gold in your mind."

"We're

like goldfields. Until we dig deep to find what's

inside us, our true potentials may be hidden forever."

"If

you want to find gold, you've got to love the process

of digging."

"Even

if you're sitting on a gold mine, you still have to

dig."

"Develop

men the same way gold is mined"

"Don't

go into the mine looking for dirt; instead, go in

looking for the gold."

"A

prospector's job is to remove dirt as quickly as possible"

"A

prospector who analyses every speck of dirt won't

find much gold"

"The

world is sitting on a gold mine but knows it not."

"Make new friends, but keep the old; Those are

silver, these are gold."

"All

that is gold does not glitter."

"Gold

is forever. It is beautiful, useful, and never wears

out"

"Gold

is the money of kings"

"Mining

is the art of exploiting mineral deposits at a profit.

An unprofitable mine is fit only for the sepulcher

of a dead mule."

"Anyone

can find the dirt in someone. Be the one that finds

the gold."

"True

gold fears no fire."

"The

desire of gold is not for gold. It is for the means

of freedom and benefit."

"Make

new friends, but keep the old; Those are silver, these

are gold."

"When

taken for granted, gold in one's hand is sometimes

considered like cheap copper – so are people."

Media

Man

Roy

Morgan wins Media Man 'News Services Provider Of The

Month' award; Runner-ups: X, Google News, Yahoo! Finance

Mining/Energy/Resources:

Australia and World

October

2025

October

27, 2025

Monday

Money: All That Glitters ...

(Australia

to New York, Wall St)

Mining

Stocks: (Near Live)

BHP

Group Ltd $43.54 +0.30 +0.69%

Fortescue Ltd $20.79 +0.27 +1.32%

Rio Tinto $133.49 +1.67 +1.27%

Northern Star $24.07 +0.37 +1.56%

Evolution Mining Ltd $10.64 +0.14 +1.33%

Lynas Rare Earths Ltd $18.37 -0.45 -2.39%

Mineral Resources Ltd $44.93 -0.0100 -0.022%

Gold

Price Today: 4,059.70 USD -51.50 (-1.25%)

Recent

Trend: Gold has risen approximately 6.42% over the

past month but is down 0.79% today.

Year-to-Date Performance: Up about 48.64% in 2025.

The

Lead up ...

News

Flashback (In Case You Missed It)

Oct

22

Australia

Trump

and Albanese Seal $8.5 Billion Critical Minerals Pact

Amid Rudd Rebuke

President

Donald Trump and Australian Prime Minister Anthony

Albanese signed a framework agreement on October 20,

2025, at the White House, valued at up to $8.5 billion,

to enhance supply chains for critical minerals and

rare earths, including over $3 billion in investments

for mining and processing 30 essential metals for

defense, technology, and clean energy. The deal aims

to reduce reliance on China's dominance in these resources

while reinforcing the U.S.-Australia alliance, including

AUKUS submarine efforts. During the meeting, Trump

publicly confronted Australian Ambassador Kevin Rudd

over his prior criticisms, stating 'I don't like you

either,' prompting varied reactions from Australian

officials and widespread social media attention.

News

Albanese

hits critical mass

The

$US8.5bn ($13bn) critical minerals framework agreement

between Australia and the US will result in each country

contributing at least US$1bn to critical minerals

and rare earths projects over the next six months.

They include a gallium project in Western Australia

and the Nolans rare earths project in the Northern

Territory. Meanwhile, US President Donald Trump says

the AUKUS alliance will be a "deterrence"

to Chinese aggression in the Indo-Pacific region.

Trump contends that AUKUS will not be needed to defend

Taiwan, because he does not think China will invade

the self-governed territory. Trump has also ruled

out reviewing the current tariffs on Australian imports,

stating that the nation "pays among the lowest

tariffs"; this includes a baseline tariff of

10 per cent and a 50 per cent levy on steel and aluminium

products. (RMS)

News

The

Victorian towns poised to benefit from critical minerals

deal

Edith

Cowan University's Amir Razmjou says Western Australia,

Queensland and South Australia will benefit the most

from the landmark critical minerals deal with the

US, followed by Victoria. Meanwhile, the Victorian

government notes that the state has "globally

significant" quantities of titanium, zirconium

and rare-earth elements, as well as Australia's only

operating antimony mine. It adds that growth in critical

minerals could "inject billions of dollars of

benefits" into regional Victoria; the Gippsland,

Wimmera and Mallee regions account for the bulk of

the state's critical minerals. However, farmers have

warned that developing these deposits must not jeopardise

the state's food bowl.

News

Flashback

News

Lead Up

PM

to meet White House mining gurus to help solve crisis

Prime

Minister Anthony Albanese will attend an event in

Washington on Tuesday to mark the 140th anniversary

of mining company BHP. US Interior Secretary Doug

Burgum and National Security Council adviser David

Copley will be present at the event, with both men

heavily involved in trying to solve the US's critical

minerals crisis. A former executive of US gold, copper

and zinc miner Newmont, Copley is viewed as the White

House's unofficial mining guru, while Burgum has taken

a keen interest in the efforts of BHP and fellow Australian

mining firm Rio Tinto to establish a large copper

mine in Arizona. (RMS)

News

NuCoal

to blight pitch on minerals

There

are claims that the cancellation of a coal mining

licence by the NSW government in 2014 represents a

breach of the Australian-US free trade act. The licence

was held by NuCoal, with US investors in NuCoal seeking

as much as $500 million in compensation for the cancellation.

Nick Farr-Jones, director of Taurus Funds Management,

which represents US shareholders in NuCoal, says Prime

Minister Anthony Albanese should use his trip to Washington

and his meeting with US President Donald Trump as

an opportunity to compensate the US investors. Farr-Jones

says Australia needs to "right this wrong"

if the federal government is to have any credibility

when it comes to mineral rights. (RMS)

News

Gold

Bulls have no choice but to push

Gold's

rally to record highs above $4,300 per ounce resulted

from a debasement trade. Governments cannot cope with

budget deficits, are accumulating debt and demanding

that central banks cut interest rates, as in the US,

or keep them low, as in Japan. As a result, investors

are losing confidence in government bonds and currencies.

They are looking for alternatives and turning their

attention to precious metals. As a result, gold has

been gaining for the last nine weeks, the fifth time

in the history of free currency conversion since the

1970s. However, there has never been a 10-week consecutive

growth period. The gap from the 200-week moving average

also shows the excessiveness of the rally. The spot

price at its peak exceeded this line by 90%. There

has only been one larger gap once before, in 1980.

At the very least, the market needs a technical respite.

But historically, its beginning could be the start

of a significant multi-year reversal. Now, we are

on the side of the bears, but at the same time, we

understand that the bulls simply have no choice but

to push the price further up, as stopping would ruin

the whole game. Each time, gold finds a new driver

of growth. In the summer, there were expectations

of a resumption of the Fed's easing cycle. To be cont...

(FxPro)

News

Rinehart's

rare earths shares top $3.5b as Trump needles China

Hancock

Prospecting has increased its exposure to the rare

earths sector after participating in St George Mining's

$72.5m capital raising. The latter had initially sought

to raise $40m, but increased this to $50m in response

to strong demand from institutional investors. St

George subsequently also agreed to issue Hancock with

$22.5m worth of shares, lifting the Gina Rinehart-controlled

company's stake to around six per cent. St George

will use the proceeds of the capital raising to expand

its Araxa project in Brazil. Hancock's other investments

in the sector include Lynas Rare Earths, Arafura Rare

Earths and US-based MP Materials. (RMS)

News

Flashback

PM

has his work cut out striking rare earths deal with

Trump

Prime

Minister Anthony Albanese is hoping to secure a deal

with US President Donald Trump regarding the US getting

access to Australia's rare earths, but it may not

be as easy as Albanese might hope. The Trump administration

is seen as being divided into two camps on the issue,

namely the resource nationalists and the economic

rationalists, and the first one is currently holding

sway. They believe the US should create an end-to-end

critical mineral supply chain, and it was probably

behind the recent US government investments and equity

stakes in US critical minerals mining firms Lithium

Americas and MP Materials. The economic rationalists

camp believes the US needs the help of its allies

to meet its critical mineral needs, at least in the

short term, with it being noted it can take more than

20 years to open a new mine in the US. (RMS)

News

Minerals/Politics

Stockpile

of critical metals urgent: miners

The

federal government aims to establish its $1.2bn critical

minerals strategic reserve by late 2026. However,

the mining industry has warned the government that

it must act more quickly to build the minerals stockpile,

contending that another mining nation could potentially

trump Australia and become a supplier of choice to

defence partners such as the US and Japan. Meanwhile,

the industry is believed to have been told that the

government may use contracts for difference to set

a 'floor price' for critical minerals. The strategic

reserve is expected to a priority when Prime Minister

Anthony Albanese meets US President Donald Trump at

the White House next week. (RMS)

News

Australian/Asia

Pacific News

Rio

set to shutter Tomago smelter

The

Tomago aluminium smelter's coal-fired power supply

contract with AGL Energy is set to expire in 2028,

and it faces the prospect of a massive increase in

power costs under any new supply agreement. This makes

it highly likely that Rio Tinto and its partners in

Tomago will permanently shut down the NSW smelter

in 2028, unless investment in renewable energy in

the state is ramped up significantly in the next few

years. The cost of electricity is also a major threat

to the future of Rio Tinto's Bell Bay aluminium smelter

in Tasmania, with its current supply deal to expire

at the end of this year. The Tomago smelter employs

more than 1,000 people. (RMS)

News

Ellison

loses key ally in MinRes board exodus

Iron

ore and lithium producer Mineral Resources has appointed

Colin Moorhead and Susan Ferrier as non-executive

directors. Their recruitment follows the departure

of six members of Mineral Resources' board in recent

months; this includes Zimi Meka, whose resignation

was announced on Friday. The recent departures mean

that only three of the nine MinRes directors who attended

its 2024 AGM will front shareholders at this year's

meeting; they include embattled MD Chris Ellison,

who has previously committed to stepping down by mid-2026.

(RMS)

News

Rare

earths market splits into light and medium-heavy segments

There

are increasing signs that the rare earths market is

splitting into two distinct segments, namely light

elements such as as neodymium and praseodymium, and

medium-heavy elements such as dysprosium and terbium.

The Shanghai Metal Market suggests that while demand

for light elements remains stable, demand for medium-heavy

elements is weak, and procurement teams need to differentiate

between these segments when negotiating contracts.

US buyers need to cultivate relationships with non-Chinese

suppliers, as well as keeping an eye on government

equity moves, as Washington's willingness to take

direct stakes in projects like Tanbreez suggests future

deals are likely.

News

Rio,

Japanese in Pilbara mine deal

Rio

Tinto has secured state and federal government approvals

to develop new iron ore deposits at the West Angelas

hub in the Pilbara. Rio Tinto and its Robe River joint

venture partners, Mitsui and Nippon Steel, will invest

$US733m ($1.1bn) to expand the West Angelas mine,

with Rio Tinto to contribute $US389m. The expansion

of West Angelas will maintain its annual production

capacity of 35 million tonnes. Rio Tinto launched

its Western Range iron ore joint venture with China-based

Baowu in June, as part of its ongoing commitment to

the Pilbara. (RMS)

News

Loophole

use in $2.4b gold deal leads to reform calls

Shares

in gold miner Predictive Discovery have rallied in

the wake of a proposed merger with Toronto-listed

Robex. Predictive's shareholders will control 51 per

cent of the merged group, although they will not be

given a vote on the deal. In contrast, the merger

will need to be approved by at least two-thirds of

Robex shareholders. The proposed merger has prompted

renewed scrutiny of the ASX's listing rules, which

allow companies to waive the requirement for a shareholder

vote under certain circumstances. Simon Mawhinney

from Allan Gray Australia has likened the Predictive

deal to James Hardie's merger with Azek earlier this

year. (RMS)

News

GoldMining

Inc. launches 2025 exploration at São Jorge,

Brazil

Comprehensive

program targets copper-gold zones; recent drilling

hit 2.79 g/t AuEq over 79m, including antimony mineralization.

Company also expands land package and updates mineral

resource estimates.

News

Nevada

Gold Mines deploys autonomous haul trucks

Fleet

of 300- and 230-tonne trucks automated using Komatsu's

FrontRunner system across U.S. surface operations

for efficiency gains.

News

Calls

for uranium listing as US goes all out on nuclear

power

Shadow

energy minister Dan Tehan says White House officials

emphasised during his recent visit to the US thart

a secure supply of uranium is a priority for the Trump

administration. Tehan contends that the federal government

should therefore add uranium to its critical minerals

list, and include it in any deal with the US for an

exemption from its reciprocal tariffs regime. Australia

accounts for about one-third of the world's known

reserves, although the nation's exports of unenriched

uranium comprises just 10 per cent of global supply

at present. Tehan recently reiterated that nuclear

power will remain part of the Coalition's energy policy.

(RMS)

News

BHP

salutes Japan 'trust'

BHP's

president of its Australian operations, Geraldine

Slattery, addressed an Australia-Japan business conference

on Monday. She declined to comment on unconfirmed

reports that China has banned the resources group's

Pilbara iron ore shipments. Instead, she emphasised

BHP's "deep" relationship with Japan and

the free-trade relations between the two nations.

Slattery highlighted the level of trust and transparency

in the relationship between Australia and Japan. (RMS)

News

MinRes

appoints company secretary

Iron

ore and lithium producer Mineral Resources has appointed

Sarah Standish as its joint company secretary. Standish

will replace CFO Mark Wilson in the role, which she

will share with Derek Oelofse. Mineral Resources has

released a statement in which it notes that Standish

has 20 years of experience in legal, governance, risk

and compliance functions at both ASX-listed and international

companies in the mining and energy sectors. Her appointment

has coincided with the Australian Securities &

Investments Commission investigation into corporate

governance issues at Mineral Resources. (RMS)

News

Upstart

glisters among surging gold miners

The

gold price has risen by almost 50 per cent in US dollar

terms so far in 2025. This has in turn boosted the

share prices of Australian gold producers; Northern

Star Resources' market capitalisation has increased

by 60 per cent so far in 2025, reaching a record high

of $35bn last week. Meanwhile, Westgold Resources'

share price rose by 24 per cent last week, lifting

its market capitalisation from $4bn to $5.1bn; this

followed its announcement of plans to lift gold production

by 45 per cent to 470,000 ounces over the next three

years. (RMS)

News

Lynas

revisited: Can it reclaim its crown in rare earths?

Lynas

Rare Earths is one of the few players in the sector

outside China with genuine scale, but it is now at

a critical juncture. A vertically integrated business

model allows Lynas to produce a range of refined products,

particularly neodymium and praseodymium. However,

its product mix has leaned heavily toward light rare

earths, leaving it exposed to pricing volatility.

The most notable development in 2025 has been Lynas's

breakthrough into heavy rare earths; the company announced

its first production of dysprosium oxide in May, followed

by terbium oxide at its Malaysian plant in June. This

milestone currently makes Lynas the only commercial-scale

producer of separated heavy rare earths outside China.

Potential risks for Lynas include cost inflation,

the ongoing threat of competition from China and uncertainty

regarding the future of its licence in Malaysia. (RMS)

News

MinRes

scores legal win on port levies

The

Supreme Court of Western Australia has ruled that

Mineral Resources and its lawyers should be allowed

to see details of a controversial agreement between

the state government and Chevron. The state-owned

Pilbara Ports Authority had sought to block access

to the agreement, which requires MinRes to pay a levy

for using a cargo wharf and part of a shipping channel

that had been dredged by Chevron for its Wheatstone

LNG project. Chevron also built the Port of Ashburton,

which MinRes now uses to export iron ore from its

Onslow Iron project. (RMS)

News

Rare

earth magnets have become the new battleground for

global power

The

unique properties of rare earth magnets have resulted

in them becoming strategic assets, and supply chain

control is increasingly being viewed as a matter of

national security. China dominates the global production

and supply of rare earth magnets, and this dependence

on China was underlined earlier this year when the

nation imposed export controls. Four rare earth magnet

factories are currently under construction in the

US, but China has been investing in rare earths processing

for decades; it also manufactures most of the world's

refining equipment and employs most of the specialised

technicians, so ending China's dominance is likely

to take years. (RMS)

News

BHP

Faces Chinese Iron Ore Ban Amid Pricing Dispute:

Reports

emerged that China's state-run iron ore buyers have

instructed steelmakers to halt purchases of dollar-denominated

cargoes from BHP, causing the company's shares to

drop 1.8%. This escalates a broader pricing row, with

BHP's stock closing at A$41.91 (down 0.73%). Analysts

warn of potential supply chain disruptions for Australia's

largest exporter.

Rio

Tinto Eyes Early Closure of Queensland's Largest Coal

Power Station:

The

mining giant notified the Australian Energy Market

Operator of a potential shutdown of its 1,000 MW coal-fired

plant at the Tarong site as early as March 2029—six

years ahead of schedule. This aligns with Rio's decarbonization

push but raises concerns over energy reliability in

coal-dependent Queensland.

Alcoa

Permanently Closes Kwinana Alumina Refinery:

The

U.S.-based firm confirmed the shutdown of its Western

Australian facility after 60 years, citing high energy

costs and global oversupply. This impacts 400 jobs

and underscores aluminium sector struggles, with WA's

government exploring support for affected workers.

Coal

Royalty Pressures Lead to Job Cuts:

BHP's

closure of the Saraji South mine in Queensland's Bowen

Basin will eliminate 750 jobs, blamed on royalties

eight times higher than 2024 profits.

Anglo

American announced further redundancies at its Grosvenor

mine and Brisbane office (potentially 1,000+ roles).

Queensland's government offers fee relief but resists

royalty cuts.

News

Flashback

Events

The

sector gears up for major gatherings focusing on innovation

and investment:

WA

Mining Conference & Exhibition: October 8–9,

Perth Convention Centre—spotlighting future tech,

sustainability, and critical minerals. Expected to

draw thousands for networking and demos.

International

Mining & Resources Conference (IMARC): October

21–23, Sydney—featuring leaders from 120+

countries, including Federal Resources Minister Madeleine

King. Themes include global investment and decarbonization.

Asia-Pacific

International Mining Exhibition (AIMEX):

September

23–25, Adelaide (ongoing as of early October)—showcasing

automation and safety, with the Australian Mining

Prospect Awards at Adelaide Oval.

News

Flashback

Trump

seeks equity stakes in critical mineral producers

The

US Department of Defense bought $US400m ($607m) worth

of shares in rare earths producer MP Materials earlier

in 2025. The Trump administration is said to be looking

at buying equity-like stakes in other producers of

critical minerals, according to executives of Australian

mining companies who recently held talks with officials

from various US government agencies. Amongst other

things, the government is said to be interested in

buying stock warrants, which would grant it the right

to buy shares in a mining company. The US aims to

reduce its reliance on China for minerals that are

crucial for defence technology and the energy transition.

(RMS)

News

Argonaut

tips gold to hit $US4500, lithium revival as supply

tightens

The

gold price has risen by 45 per cent so far in 2025,

and it is currently trading above $US3,800 per ounce.

Perth-based stockbroker Argonaut is bullish about

the outlook for bullion, lifting its peak price forecast

to US$4,500. Argonaut's executive chairman and co-founder

Eddie Rigg also anticipates further consolidation

in the gold sector. Meanwhile, Rigg expects the lithium

price to rebound, arguing that proposed new projects

in South America and Africa are unlikely to proceed

in the near-term; he notes that they will be capital-intensive,

while many are in volatile jurisdictions. (RMS)

News

News

Flashback

Profile

Hancock

Prospecting

Hancock

Prospecting Pty Ltd is an Australian-owned mining

and agricultural business run by Executive Chairwoman

Gina Rinehart and CEO Garry Korte. At various stages

of its trading history, the company has been known

as Hancock Prospecting Ltd, Hancock Resources Ltd,

Hanwright Pty Ltd, Hancock & Wright Ltd, and Hancock

Prospecting Pty Ltd.

Hancock

Prospecting Pty Ltd is owned by Rinehart (76.6%) and

the Hope Margaret Hancock Trust (23.4%).

The

company was founded in 1955 by Rinehart's father,

the late Lang Hancock. Hancock Prospecting holds the

mineral rights to some of the largest Crown land leases

in the Pilbara region of Western Australia.

Gina

Rinehart has disputed accusations that she is an heiress.

Through Rinehart's spokesperson and chief financial

officer at Hancock Prospecting, Jay Newby, Rinehart

has claimed that upon assuming the role of the Executive

Chairwoman, she took over a company that was in a

perilous financial position with significant debt

and major assets mortgages and under threat of seizure.

Projects:

Balfour

Downs Station Manganese Operation, northeast of Newman,

a joint venture with Mineral Resources

Hope

Downs mine, northwest of Newman, a joint venture with

Rio Tinto

Roy

Hill project, south of Port Hedland, a joint venture

between Hancock Prospecting (70%), Marubeni (15%),

POSCO (12.5%), and China Steel Corporation (2.5%)

Alpha

Coal project, Galilee Basin in Central Queensland

Kevin's

Corner coal project, Galilee Basin in Central Queensland

Nicholas

Downs mine, northwest of Newman, a joint venture with

Mineral Resources

(Developing

profile/news). To be cont ...

News

Best

Quotes

The

best and biggest gold mine is in between your ears."

"You

are a gold mine of potential power. You have to dig

to find it and make it real."

"Your

mind is like a gold mine, if you dig deep you will

find something golden."

"Don't

die without mining the gold in your mind."

"We're

like goldfields. Until we dig deep to find what's

inside us, our true potentials may be hidden forever."

"If

you want to find gold, you've got to love the process

of digging."

"Even

if you're sitting on a gold mine, you still have to

dig."

"Develop

men the same way gold is mined"

"Don't

go into the mine looking for dirt; instead, go in

looking for the gold."

"A

prospector's job is to remove dirt as quickly as possible"

"A

prospector who analyses every speck of dirt won't

find much gold"

"The

world is sitting on a gold mine but knows it not."

"Make new friends, but keep the old; Those are

silver, these are gold."

"All

that is gold does not glitter."

"Gold

is forever. It is beautiful, useful, and never wears

out"

"Gold

is the money of kings"

"Mining

is the art of exploiting mineral deposits at a profit.

An unprofitable mine is fit only for the sepulcher

of a dead mule."

"Anyone

can find the dirt in someone. Be the one that finds

the gold."

"True

gold fears no fire."

"The

desire of gold is not for gold. It is for the means

of freedom and benefit."

"Make

new friends, but keep the old; Those are silver, these

are gold."

"When

taken for granted, gold in one's hand is sometimes

considered like cheap copper – so are people."

Media

Man

Roy

Morgan wins Media Man 'News Services Provider Of The

Month' award; Runner-ups: X, Google News, Yahoo! Finance

Mining/Energy/Resources:

Australia and World

October

2025

October

21, 2025

Monday

Money: All That Glitters ...

(New

York, Wall St)

Mining

Stocks: (Near Live)

BHP

Group Ltd $43.63 -0.50 -1.13%

Fortescue Ltd $20.31 -0.56%

Rio Tinto $130.11 -1.78 -1.35%

Northern Star $23.46 -2.38 -9.21%

Evolution Mining Ltd $10.58 -1.01 -8.71%

Lynas Rare Earths Ltd $18.11 -0.86 -4.51%

Mineral Resources Ltd $41.38 -0.79 -1.87%

Gold

Price Today: 4,122.58 -219.77 -5.06%

News

Oct

22

Australia

Trump

and Albanese Seal $8.5 Billion Critical Minerals Pact

Amid Rudd Rebuke

President

Donald Trump and Australian Prime Minister Anthony

Albanese signed a framework agreement on October 20,

2025, at the White House, valued at up to $8.5 billion,

to enhance supply chains for critical minerals and

rare earths, including over $3 billion in investments

for mining and processing 30 essential metals for

defense, technology, and clean energy. The deal aims

to reduce reliance on China's dominance in these resources

while reinforcing the U.S.-Australia alliance, including

AUKUS submarine efforts. During the meeting, Trump

publicly confronted Australian Ambassador Kevin Rudd

over his prior criticisms, stating 'I don't like you

either,' prompting varied reactions from Australian

officials and widespread social media attention.

News

Albanese

hits critical mass

The

$US8.5bn ($13bn) critical minerals framework agreement

between Australia and the US will result in each country

contributing at least US$1bn to critical minerals

and rare earths projects over the next six months.

They include a gallium project in Western Australia

and the Nolans rare earths project in the Northern

Territory. Meanwhile, US President Donald Trump says

the AUKUS alliance will be a "deterrence"

to Chinese aggression in the Indo-Pacific region.

Trump contends that AUKUS will not be needed to defend

Taiwan, because he does not think China will invade

the self-governed territory. Trump has also ruled

out reviewing the current tariffs on Australian imports,

stating that the nation "pays among the lowest

tariffs"; this includes a baseline tariff of

10 per cent and a 50 per cent levy on steel and aluminium

products. (RMS)

News

The

Victorian towns poised to benefit from critical minerals

deal

Edith

Cowan University's Amir Razmjou says Western Australia,

Queensland and South Australia will benefit the most

from the landmark critical minerals deal with the

US, followed by Victoria. Meanwhile, the Victorian

government notes that the state has "globally

significant" quantities of titanium, zirconium

and rare-earth elements, as well as Australia's only

operating antimony mine. It adds that growth in critical

minerals could "inject billions of dollars of

benefits" into regional Victoria; the Gippsland,

Wimmera and Mallee regions account for the bulk of

the state's critical minerals. However, farmers have